CANARA ROBECO EQUITY HYBRID FUND (CREHF)

Aggressive Hybrid Fund - An open-ended hybrid scheme investing predominantly in equity and equity related instruments

(as on August 29, 2025)

| SCHEME OBJECTIVE | To seek to generate long term capital appreciation and/or income from a portfolio constituted of equity and equity related securities as well as fixed income securities (debt and money market securities). However, there can be no assurance that the investment objective of the scheme will be realized |

| DATE OF ALLOTMENT | February 1, 1993 |

| BENCHMARK | CRISIL Hybrid 35+65 - Aggressive Index |

| FUND MANAGER | For Equity Portfolio 1) Ms. Ennette Fernandes 2) Mr. Shridatta Bhandwaldar For Debt Portfolio 3) Mr. Avnish Jain |

| TOTAL EXPERIENCE | 1) 15 Years 2) 19 Years 3) 30 Years |

| MANAGING THIS FUND | 1) Since 01-Oct-21 2) Since 5-July-16 3) Since 7-Oct-13 |

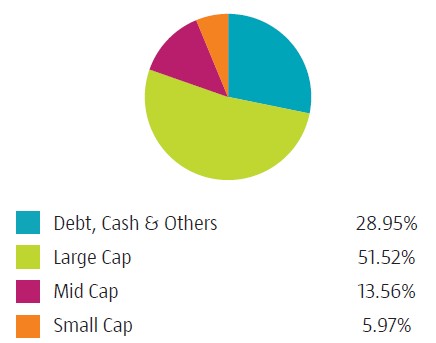

| ASSET ALLOCATION | Equity and equity related instruments- 65% - 80%. Debt and money market instruments 20% to 35%. REITs/ InvITs – 0%-10% For detailed asset allocation pattern, please refer the Scheme Information Document |

| MINIMUM INVESTMENT | Lump sum Investment: ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter Systematic Investment Plan (SIP): For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter. For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter Systematic Transfer Plan (STP): For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter. For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter Systematic Withdrawal Plan (SWP): For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter. For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter For Annual Frequency– ₹ 2,000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Monthly Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Monthly Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Monthly Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Monthly Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| EXIT LOAD | 1% - if redeemed/switched out within 365 days from the date of allotment. Nil - if redeemed/switched out after 365 days from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan :1.72% Direct Plan: 0.57% |

| Month end Assets Under Management (AUM)# | ₹ 10,946.28 Crores |

| Monthly AVG Assets Under Management (AAUM | ₹ 11,020.77 Crores |

| (as on August 29, 2025) | (₹) |

| Direct Plan - Growth Option | 401.3700 |

| Regular Plan - Growth Option | 354.3300 |

| Regular Plan - Monthly IDCW (payout/reinvestment) | 95.9000 |

| Direct Plan - Monthly IDCW (payout/reinvestment) | 131.0600 |

| Equity Quants | |

| Standard Deviation | 10.20 |

| Portfolio Beta | 1.06 |

| Portfolio Turnover Ratio (Equity) | 0.15 times |

| Portfolio Turnover Ratio (Total) | 0.47 times |

| Sharpe Ratio | 0.71 |

| R-Squared | 0.96 |

| Debt Quants | |

| Annualised Portfolio YTM | 6.61% |

| Modified Duration | 2.60 Years |

| Residual Maturity | 4.67 Years |

| Macaulay Duration | 2.72 Years |

Name of the Instruments |

% to NAV |

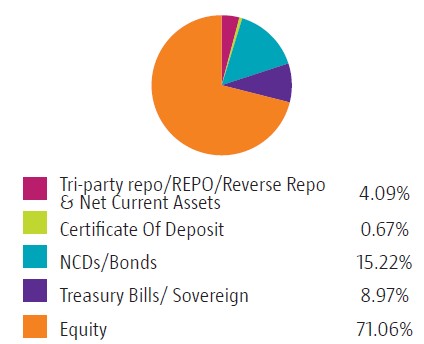

Equities |

71.05% |

Listed |

71.05% |

Banks |

15.14% |

HDFC Bank Ltd |

6.12% |

ICICI Bank Ltd |

4.34% |

Axis Bank Ltd |

1.88% |

State Bank of India |

1.73% |

Indian Bank |

1.07% |

Finance |

5.50% |

Power Finance Corporation Ltd |

2.13% |

Bajaj Finance Ltd |

1.72% |

Cholamandalam Financial Holdings Ltd |

1.08% |

PNB Housing Finance Ltd |

0.57% |

IT - Software |

4.92% |

Infosys Ltd |

2.31% |

Tech Mahindra Ltd |

1.19% |

Tata Consultancy Services Ltd |

0.70% |

HCL Technologies Ltd |

0.38% |

Sonata Software Ltd |

0.34% |

Auto Components |

3.49% |

Samvardhana Motherson International Ltd |

1.33% |

Uno Minda Ltd |

1.13% |

Motherson Sumi Wiring India Ltd |

0.64% |

Sona Blw Precision Forgings Ltd |

0.39% |

Retailing |

3.48% |

Eternal Ltd |

1.91% |

Avenue Supermarts Ltd |

0.59% |

FSN E-Commerce Ventures Ltd |

0.58% |

Info Edge (India) Ltd |

0.40% |

Petroleum Products |

3.28% |

Reliance Industries Ltd |

2.67% |

Bharat Petroleum Corporation Ltd |

0.61% |

Automobiles |

2.95% |

TVS Motor Co Ltd |

1.26% |

Maruti Suzuki India Ltd |

1.02% |

Bajaj Auto Ltd |

0.67% |

Insurance |

2.69% |

Max Financial Services Ltd |

0.98% |

ICICI Lombard General Insurance Co Ltd |

0.86% |

SBI Life Insurance Co Ltd |

0.85% |

Pharmaceuticals & Biotechnology |

2.57% |

Sun Pharmaceutical Industries Ltd |

1.03% |

Divi's Laboratories Ltd |

1.01% |

Piramal Pharma Ltd |

0.53% |

Construction |

2.43% |

Larsen & Toubro Ltd |

1.89% |

KEC International Ltd |

0.54% |

Telecom - Services |

2.42% |

Bharti Airtel Ltd |

2.42% |

Power |

2.17% |

NTPC Ltd |

1.37% |

Tata Power Co Ltd |

0.80% |

Electrical Equipment |

2.16% |

Ge Vernova T&D India Ltd |

1.46% |

CG Power and Industrial Solutions Ltd |

0.70% |

Consumer Durables |

1.77% |

Voltas Ltd |

0.92% |

Titan Co Ltd |

0.85% |

Beverages |

1.61% |

United Spirits Ltd |

0.81% |

Varun Beverages Ltd |

0.80% |

Capital Markets |

1.56% |

Prudent Corporate Advisory Services Ltd |

0.83% |

BSE Ltd |

0.73% |

Cement & Cement Products |

1.54% |

J.K. Cement Ltd |

1.54% |

Chemicals & Petrochemicals |

1.43% |

Vinati Organics Ltd |

0.76% |

Navin Fluorine International Ltd |

0.67% |

Diversified Fmcg |

1.16% |

ITC Ltd |

1.16% |

Transport Services |

1.11% |

Interglobe Aviation Ltd |

1.11% |

Consumable Fuels |

1.09% |

Coal India Ltd |

1.09% |

Healthcare Services |

1.02% |

Max Healthcare Institute Ltd |

1.02% |

Industrial Products |

1.00% |

KEI Industries Ltd |

1.00% |

Realty |

0.94% |

Oberoi Realty Ltd |

0.94% |

Aerospace & Defense |

0.88% |

Bharat Electronics Ltd |

0.88% |

Personal Products |

0.77% |

Godrej Consumer Products Ltd |

0.77% |

Household Products |

0.58% |

Jyothy Labs Ltd |

0.58% |

Fertilizers & Agrochemicals |

0.56% |

PI Industries Ltd |

0.56% |

Entertainment |

0.51% |

PVR Inox Ltd |

0.51% |

Financial Technology (Fintech) |

0.25% |

One 97 Communications Ltd |

0.25% |

Leisure Services |

0.07% |

ITC Hotels Ltd |

0.07% |

Debt Instruments |

15.21% |

Small Industries Development Bank Of India |

0.93% |

Bajaj Finance Ltd |

0.92% |

LIC Housing Finance Ltd |

0.47% |

HDB Financial Services Ltd |

0.46% |

Kotak Mahindra Prime Ltd |

0.46% |

REC Ltd |

0.46% |

HDB Financial Services Ltd |

0.46% |

REC Ltd |

0.46% |

National Bank For Agriculture & Rural Development |

0.46% |

REC Ltd |

0.46% |

REC Ltd |

0.46% |

LIC Housing Finance Ltd |

0.46% |

HDB Financial Services Ltd |

0.46% |

Bajaj Finance Ltd |

0.46% |

Bajaj Housing Finance Ltd |

0.46% |

HDB Financial Services Ltd |

0.46% |

National Bank For Agriculture & Rural Development |

0.42% |

National Bank For Agriculture & Rural Development |

0.37% |

LIC Housing Finance Ltd |

0.37% |

LIC Housing Finance Ltd |

0.27% |

LIC Housing Finance Ltd |

0.23% |

Small Industries Development Bank Of India |

0.23% |

Sundaram Finance Ltd |

0.23% |

LIC Housing Finance Ltd |

0.23% |

LIC Housing Finance Ltd |

0.23% |

LIC Housing Finance Ltd |

0.23% |

Small Industries Development Bank Of India |

0.23% |

LIC Housing Finance Ltd |

0.23% |

Small Industries Development Bank Of India |

0.23% |

REC Ltd |

0.23% |

LIC Housing Finance Ltd |

0.23% |

Indian Railway Finance Corporation Ltd |

0.23% |

Bajaj Finance Ltd |

0.23% |

Small Industries Development Bank Of India |

0.23% |

Small Industries Development Bank Of India |

0.23% |

Power Finance Corporation Ltd |

0.23% |

HDB Financial Services Ltd |

0.23% |

ICICI Home Finance Co Ltd |

0.23% |

National Bank For Agriculture & Rural Development |

0.23% |

HDFC Bank Ltd |

0.23% |

HDFC Bank Ltd |

0.23% |

HDFC Bank Ltd |

0.23% |

Kotak Mahindra Prime Ltd |

0.14% |

Power Finance Corporation Ltd |

0.14% |

National Bank For Agriculture & Rural Development |

0.09% |

Indian Railway Finance Corporation Ltd |

0.02% |

6.00% TVS Motor Co Ltd Non Convertible Redeemable Preference Shares |

0.02% |

National Bank For Agriculture & Rural Development |

0.01% |

GOVERNMENT SECURITIES |

8.88% |

GOI FRB 2034 (30-OCT-2034) |

1.74% |

6.79% GOI 2034 (07-OCT-2034) |

1.38% |

6.33% GOI 2035 (05-MAY-2035) |

1.30% |

7.30% GOI 2053 (19-JUN-2053) |

0.73% |

7.34% GOI 2064 (22-APR-2064) |

0.50% |

7.32% GOI 2030 (13-NOV-2030) |

0.48% |

6.79% GOI 2031 (30-DEC-2031) |

0.46% |

6.28% GOI 2032 (14-JUL-2032) |

0.45% |

8.08% TAMIL NADU SDL 26-DEC-28 |

0.43% |

7.48% MAHARASHTRA SDL 07-FEB-35 |

0.23% |

7.54% ANDHRA PRADESH SDL 11-JAN-29 |

0.23% |

6.80% TAMIL NADU SDL 02-JUL-35 |

0.22% |

6.82% TAMIL NADU SDL 16-JUL-35 |

0.18% |

7.73% GUJARAT SDL 08-APR-29 |

0.14% |

7.24% RAJASTHAN SDL 04-SEP-34 |

0.14% |

6.68% GOI 2040 (07-JUL-2040) |

0.13% |

7.17% RAJASTHAN SDL 27-FEB-35 |

0.09% |

8.15% GOI 2026 (24-NOV-2026) |

0.05% |

Money Market Instruments |

4.24% |

HDFC Bank Ltd |

0.45% |

Axis Bank Ltd |

0.22% |

Treasury Bills |

0.09% |

TREPS |

3.48% |

Net Current Assets |

0.62% |

GRAND TOTAL ( NET ASSET) |

100.00% |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (CRISIL Hybrid 35+65 - Aggressive Index) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 29.08.2025 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.

The Scheme and Benchmark riskometers are evaluated on a monthly basis and the above

riskometers are based on the evaluation of the portfolios for the month ended August 29, 2025.