Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

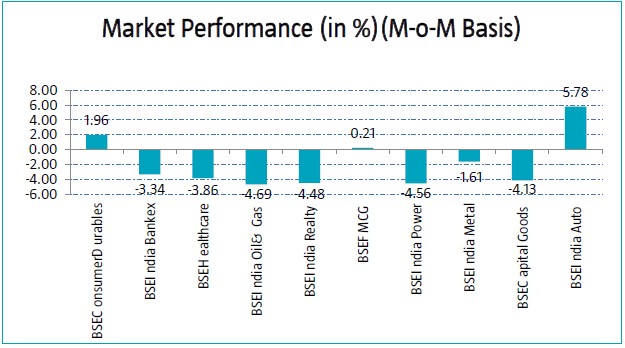

- In the month of Aug’25, Nifty 50 dropped sharply by 1.38% due to signs of weakening earnings momentum among domestic companies in Q1FY26 and additional 25% tariff imposed by the U.S. President on India which came into effect on Aug 27, 2025. Investor sentiment weakened as the 50% tariff hike threatened India’s manufacturing push and could slow economic growth. Continuous selling by foreign portfolio investors added to the downward pressure on the markets, extending the losses.

- Foreign Institutional Investors (FIIs) were net sellers in Indian equities to the tune of ₹ 34993.16 crore.

- Gross Goods and Services Tax (GST) collections in Aug’25 stood at Rs. 1.86 trillion, representing a 6.5% rise on a yearly basis and this points towards the growing trajectory of the Indian economy.

- The combined Index of Eight Core Industries (Refinery Products Industry, Electricity, Industry, Steel Industry, Coal Industry, Crude Oil Industry, Natural Gas Industry, Cement Industry, Fertilizers Industry) rose by 2.0% YoY in Jul 2025, compared to a 2.2% increase in Jun 2024. Among the eight sectors, steel and cement recorded the highest growth at 12.8% and 11.7%, respectively. In contrast, coal saw the steepest decline, falling by 12.3%.

- Globally, U.S. equity markets went up as investors welcomed strong earnings and anticipated interest rate cuts. Investors shrugged off concerns about the economic impact of the President’s new tariffs on dozens of U.S. trading partners added to the gains. European markets rose amid optimism over a potential peace deal between Russia and Ukraine as there was diplomatic progress involving leaders from the U.S. and Europe. Asian equities ended mixed, buoyed by dovish remarks from the U.S. Fed Chair that raised rate cut hopes.

Note: The past performance may or may not be sustained in the future.

Source: MFI Explorer, ICRA Analytics Ltd. Data as on: 29th August’25

Equity Market Outlook

The decision of the US Government to enforce reciprocal tariff on most countries points towards its intent to aggressively pursue and resolve the wrong that it believes it is suffering since the globalisation era. It is estimated that these tariffs are likely to affect trade worth roughly US$1tn, thereby impacting Global GDP in FY26/27 by 0.5%. India too is likely to suffer a 0.5% impact on its GDP with higher tariffs. Indian situation has clearly gotten complex with Indian tariff being raised to 50% - among highest globally. It would have sizable direct and indirect impact on India – though there is no certainty that it will not change again for better or worse. Although it remains fluid and there is to and fro that’s happening over last few months. One needs to see how it plays out over next 3-6 months before making any structural view on this aspect.

While the theory of US getting short-changed by its trading partners is debatable, there is little doubt that the country was amongst the biggest beneficiaries of globalisation. As the US dominance in the global economy increased, it benefited from global savings moving back the US to fund its large fiscal and trade deficit at an interest rate of under 2-3% on an average for the past 15-20 years. On the other hand, the benefits of increased local manufacturing that is being perceived as one of the end goals of these tariffs may not be easy to materialise given ecosystem challenges. Global manufacturing supply chains have been established over the past 40-50 years and are almost impossible to move to the US easily. This is due to various limiting factors that US suffers from like lack of labour skillset and ecosystem to produce these products at competitive costs. Thus, in the near term, the strategy of stepping back from globalisation is likely to hurt US consumers as the cascading effect of these tariffs trickle down in the form of higher inflation, higher real interest rates and lower economic growth. We might have stagflation as a consequence of US policies in US and deflation globally driven by oversupply not consumed by US, like in the past.

The global macro environment remains complex as:

1) US growth inflation dynamics indicating increased possibility of stagflation.

2) Tariff news flow increases business uncertainty and keeps inflation high in an environment where the incremental data points continue to indicate consumer slowdown.

If this scenario of global uncertainty elongates, then US might be in for a negative growth surprise, when high headline inflation leaves limited room for the Fed to cut rate beyond current expectations of 50bps in CY25.

U.S President’s policies so far are indicating their inward focus with a multi-polar world and disregard for global trade and defence agreements of previous US establishments. We thus expect uncertainty to prevail both on global growth and capital flows for Emerging markets including India (although latest India – US brawl can hurt). One possibility is that it may quickly lead to a US recession potentially easing monetary policy, Fed providing liquidity and faster interest rate cuts. US dollar could depreciate under such circumstances, which could be positive for Emerging markets over next 4-6 quarters. After strengthening initially post elections - the dollar index has depreciated over last 6 months by ~15% – indicating possible flows moving towards Emerging markets and Europe. However, Europe and China’s growth rates remain subdued at best. Euro area might be an eventual beneficiary of this environment as it finally moves towards policies which make it a better economic and geopolitical zone. European leaders have been forced to make serious choices for the first time in last several decades. They may start looking towards East more and India could be beneficiary of the same along with China and Others. Geopolitics remains complex and you might get bouts of escalation and de-escalation periodically in our view. China continues to have challenges on growth revival due to ageing population and leverage in households/Real estate, which are structural in our view. Commodities in general may remain muted for extended period, given that more than 30-40% of every commodity is consumed by China and the recent tariff war and its impact on exports makes the growth environment even worse for exporting countries. Only positive for China is its relatively cheap valuations and good quality listed tech companies. Eurozone would be the area to look out for over next 5 years from growth perspective. India remains one of the differentiated markets (Goods exports just ~15% of GDP) in terms of structural growth and earnings, notwithstanding cyclical slowdown that we are witnessing right now. Biggest challenge in our worldview remains that, the US is wanting to reduce trade deficit and no one else is willing to step up including China– growth negative environment globally.

Indian macro remains best among the large economies and cyclical growth is normalising from last year. The last Gross Domestic Product (GDP) print came in at 7.4% and 7.8% in 4QFY25 and 1QFY26 respectively, after weak prints of 5.4% and 6.2% respectively for 2Q/3QFY25. FY25 GDP growth came at 6.5%. Current Account Deficit has improved significantly and is expected to be ~1% for FY25E/FY26E. Most domestic macro and micro indicators remain steady. Given these aspects, despite the global geo-political and economic dark clouds, the domestic equity market remains focused on earnings. While the structural earning growth has been healthy at >15% CAGR (Compounded Annual Growth Rate) for FY20-24, FY25E has moderated to mid-high single digit, which is a cause of concern. Thankfully 4QFY25/1QFY26 earnings have been along the expected line of consensus. Monetary policy has become very accommodative, both in terms of system liquidity (vs FY25) as well as administrative majors around lending. 1QFY26 nifty earnings growth was 8-9%YoY growth – directionally improving from previous quarters.

We believe that FY25 was a cyclical slowdown driven by factors such as,

1) Reduced Govt spending during 1HFY25, which has reversed during next 2 quarters

2) Significantly above average monsoon in southern part of country; and

3) Stringent liquidity and administrative actions by RBI on retail credit (which has also reversed).

Having discussed near term earnings challenges; we believe that Indian economy is in a structural business cycle which may come to fore as global macroeconomic challenges/flow challenges recede over next few quarters. Most of the cyclical factors mentioned above have already reversed over last 3 quarters. Consumption and revenue expenditure at State /Central level has started moving up. Our belief on domestic economic up-cycle stems from the fact that the enabling factors are in place

1) Corporate and bank’s financials are in best possible shape to drive capex and credit respectively,

2) Consumer spending likely to normalize given our demographics and Govt push

3) Government is focused on creating enabling environment through reforms and direct fiscal interventions (GST cuts, Income tax cuts and state social welfare schemes adds up to 1-2% of GDP)

4) Real estate cycle still is in mid cycle with healthy balance sheets

This makes us constructive on India equities with 3-5 years view. We believe that India is in a business cycle / credit growth / earnings cycle through FY25-28E – indicating a healthy earnings cycle from medium term perspective. Though, watch out for tariff related risk that has emanated lately with US.

Select Consumer discretionary and Financials, Pharma, industrials, Telecom, Hospital, Hotels, Aviation and Real Estate are witnessing a healthy earnings cycle whereas FMCG, Commodities and IT continues to face headwind. Indian equity market trades at 21xFY26E/19xFY27E consensus Nifty earnings – in a fair valuation zone from medium term perspective – given longevity of earnings growth potential in India. For the broader market, while the last years correction has taken out the froth in mid-caps and small caps, they continue to trade at 15-25% premium to their own historical valuations – indicating that the strong earnings revival is a must for this part of the market to do well. Stock pickers market and consolidation might be the theme of the year given muted earnings and above average valuations.

Source: ICRA MFI Explorer