CANARA ROBECO DYNAMIC BOND FUND (CRDBF)

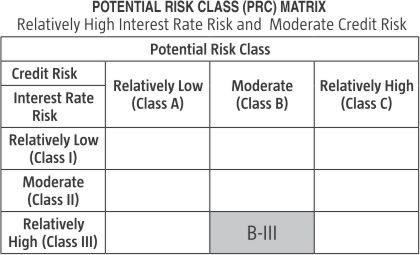

Dynamic Bond - An open ended dynamic debt scheme investing across duration. A relatively high interest rate risk and moderate credit risk.

(as on August 29, 2025)

| SCHEME OBJECTIVE | The objective of the fund is to seek to generate income from a portfolio of debt and money market securities. However, there can be no assurance that the investment objective of the scheme will be realized and the Fund does not assure or guarantee any returns. |

| DATE OF ALLOTMENT | May 29, 2009 |

| BENCHMARK | CRISIL Dynamic Bond A-III Index |

| FUND MANAGER | 1) Mr. Kunal Jain 2) Mr. Avnish Jain |

| TOTAL EXPERIENCE | 1) 17 Years 2) 30 Years |

| MANAGING THIS FUND | 1) Since 18-July-22 2) Since 01-April-22 |

| ASSET ALLOCATION | Government of India & Corporate Debt Securities (including Securitised Debt)* - 0% to 100% Money Market Instruments - 0% to 100% * Excluding Debt/GOI Securities with initial maturity of less than one year and Treasury bills For detailed asset allocation pattern, please refer the Scheme Information Document |

| MINIMUM INVESTMENT | Lump sum Investment: ₹5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter Systematic Investment Plan (SIP): For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter Systematic Transfer Plan (STP): For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter Systematic Withdrawal Plan (SWP): For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter For Annual Frequency– ₹ 2,000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| EXIT LOAD | Nil |

| EXPENSE RATIO^: |

Regular Plan : 1.75% Direct Plan : 0.67% |

| Month end Assets Under Management (AUM)# | ₹ 109.75 Crores |

| Monthly AVG Assets Under Management (AAUM) | ₹ 111.55 Crores |

| (as on August 29, 2025) | (₹) |

| Direct Plan - Growth Option | 31.8914 |

| Direct Plan - IDCW (payout/reinvestment) | 15.1366 |

| Regular Plan - Growth Option | 28.8613 |

| Regular Plan - IDCW (payout/reinvestment) | 13.5432 |

| Annualised Portfolio YTM | 6.94% |

| Modified Duration | 7.44 Years |

| Residual Maturity | 15.58 Years |

| Macaulay Duration | 7.76 Years |

Name of the Instruments |

Rating |

% to NAV |

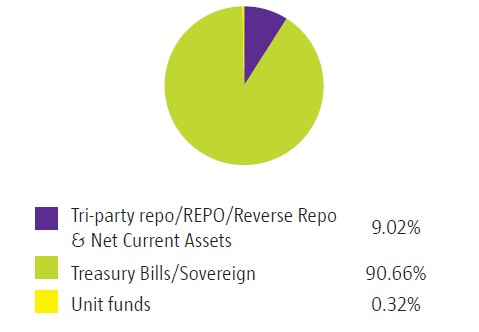

Government Securities |

|

90.66% |

6.92% GOI 2039 (18-NOV-2039) |

Sovereign |

20.37% |

6.90% UTTAR PRADESH SDL 11-MAR-30 |

Sovereign |

18.26% |

7.34% GOI 2064 (22-APR-2064) |

Sovereign |

15.82% |

7.30% GOI 2053 (19-JUN-2053) |

Sovereign |

14.99% |

6.33% GOI 2035 (05-MAY-2035) |

Sovereign |

13.41% |

7.07% KARNATAKA SDL 28-AUG-29 |

Sovereign |

4.60% |

7.38% GOI 2027 (20-JUN-2027) |

Sovereign |

2.33% |

7.17% GOI 2030 (17-APR-2030) |

Sovereign |

0.67% |

6.68% GOI 2031 (17-SEP-2031) |

Sovereign |

0.21% |

Alternative Investment Fund |

|

0.32% |

Corporate Debt Market Development Fund Class A2 |

|

0.32% |

Money Market Instruments |

|

6.68% |

TREPS |

|

6.68% |

Other Current Assets |

|

2.34% |

GRAND TOTAL ( NET ASSET) |

|

100.00% |

% Allocation |

|

Net Current Assets/ CDMDF |

2.66% |

| 0 to 3 Months | 6.68% |

1 - 2 Years |

2.33% |

| Greater than 2 Years | 88.33% |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (CRISIL Dynamic Bond A-III Index) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 29.08.2025 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.

The Scheme and Benchmark riskometers are evaluated on a monthly basis and

the above riskometers are based on the evaluation of the portfolios for the month

ended August 29, 2025.